Accomplish Your Dreams with the Support of Loan Service Experts

Wiki Article

Discover the Perfect Funding Solutions to Satisfy Your Economic Goals

In today's intricate monetary landscape, the mission to locate the best car loan services that align with your distinct financial objectives can be a difficult task. From understanding your economic needs to assessing loan provider credibility, each step in this process calls for careful factor to consider to secure the best possible end result.Examining Your Financial Demands

When considering loan solutions for your monetary goals, the first action is to extensively analyze your present economic requirements. Begin by assessing the particular purpose for which you require the financing.

In addition, it is necessary to perform a thorough review of your present financial situation. Consider variables such as your credit report score, existing financial debts, and any kind of upcoming expenses that may impact your capacity to pay off the financing.

Along with recognizing your economic needs, it is advisable to research study and contrast the lending options offered out there. Different fundings come with differing terms, rate of interest, and payment timetables. By meticulously examining your requirements, economic placement, and offered finance items, you can make an educated decision that supports your economic goals.

Recognizing Funding Options

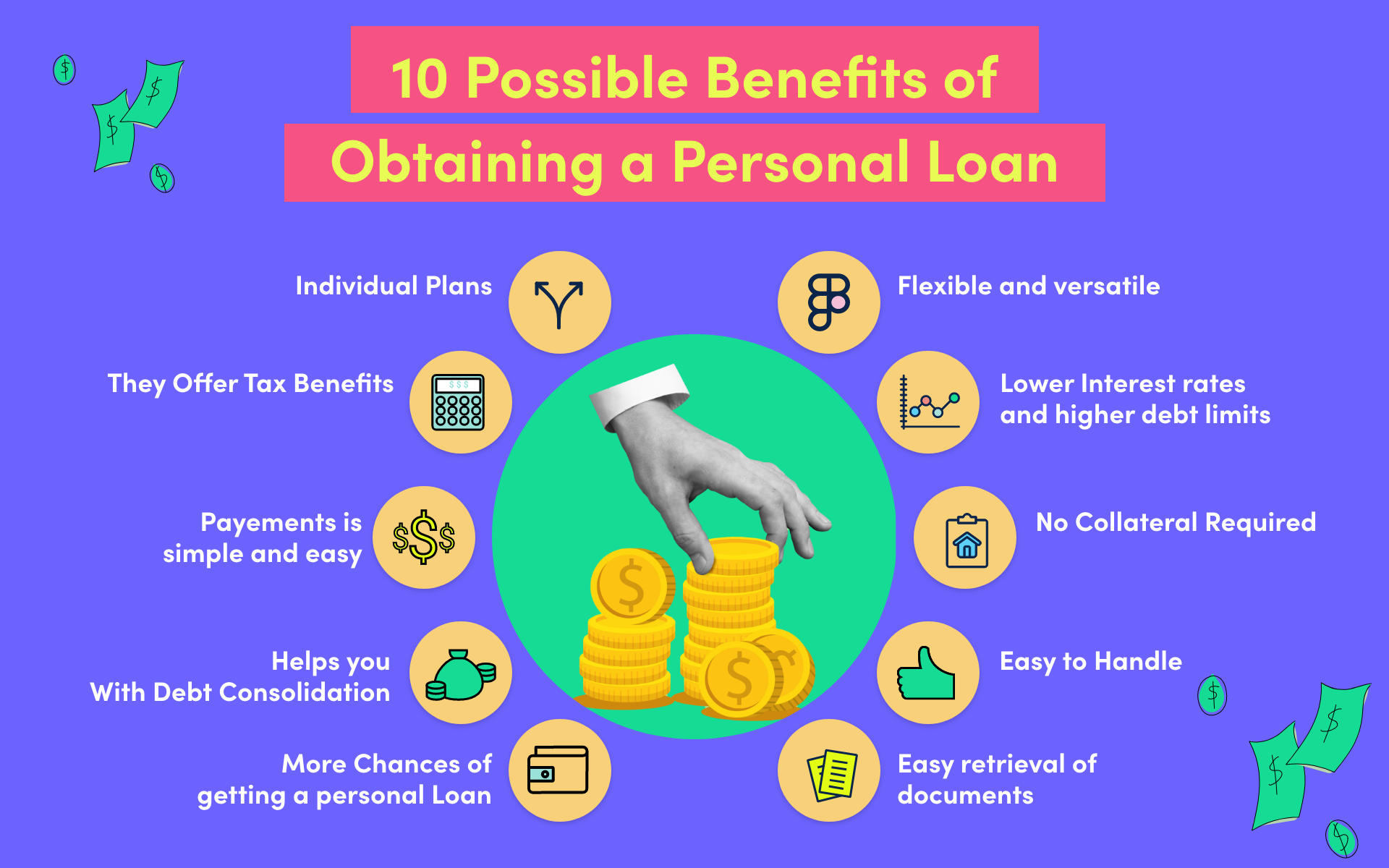

Discovering the range of financing options readily available in the financial market is necessary for making informed decisions straightened with your particular requirements and objectives. Understanding financing options includes acquainting yourself with the different kinds of car loans supplied by financial organizations. These can vary from typical options like personal financings, home loans, and vehicle lendings to a lot more customized items such as home equity lendings, cash advance, and pupil lendings.Each kind of finance features its very own terms, problems, and payment frameworks (best merchant cash advance). Personal financings, as an example, are unsecured financings that can be utilized for various purposes, while home loans are secured fundings particularly made for purchasing genuine estate. Auto fundings deal with funding car purchases, and home equity lendings allow property owners to borrow versus the equity in their homes

Comparing Passion Rates and Terms

To make enlightened decisions concerning finance alternatives, a critical action is comparing rate of interest rates and terms used by monetary organizations. Comprehending and comparing these terms can assist customers choose the most appropriate financing for their financial situation. Furthermore, assess the effect of finance terms on your economic goals, making sure that the chosen funding aligns with your budget and long-term objectives.Assessing Loan Provider Track Record

Additionally, take into consideration talking to regulative bodies or monetary authorities to ensure the lender is accredited and certified with market laws. A reliable lending institution will have a solid record of honest borrowing practices and transparent interaction with borrowers. It is likewise useful to seek recommendations from friends, family members, or economic consultants who may have experience with trustworthy lenders.

Inevitably, picking a lender with a solid reputation can provide you comfort and self-confidence in your borrowing decision (mca lender). By performing thorough research study and due persistance, you can select a loan provider that straightens with your monetary objectives and worths, setting you up for a successful loaning experience

Selecting the very best Lending for You

Having completely assessed a lending institution's reputation, the following essential step is to very carefully choose the ideal financing choice that lines up with your economic objectives and demands. When choosing a loan, think about the function of the finance.Contrast the rates of interest, financing terms, and fees offered by different lenders. Reduced passion prices can conserve you cash over the life of the financing, while beneficial terms can make payment extra workable. Consider any type of added expenses like origination costs, early repayment penalties, or insurance coverage requirements.

Additionally, focus on the settlement routine. Pick a funding with monthly payments that fit your budget plan and timeframe for repayment. Versatility in payment options can likewise be useful in situation of unexpected financial modifications. Eventually, select a lending that not just fulfills your present economic demands yet additionally supports your long-term monetary objectives.

Conclusion

Finally, finding the perfect finance services to satisfy your monetary goals needs an extensive evaluation resource of your economic demands, understanding financing alternatives, comparing rates of interest and terms, and reviewing lending institution online reputation. By thoroughly considering these factors, you can choose the finest finance for your certain circumstance. It is essential to prioritize your financial objectives and select a lending that aligns with your long-lasting financial goals.Report this wiki page